Recruitment. Australia up 🚀 UK down 🔻

I just got back from the UK, and recruiters and recruitment owners I spoke to were subdued and, in many cases, worried.

In Australia, where the market has been challenging for two years, the tone of the Board meetings I have attended since my return has been varied, but at least a third were upbeat, reporting improving demand and results.

But what do the facts tell us?

This data is mainly from Ross Clennett’s excellent blog, which I encourage you to subscribe to as soon as possible.

Australia

- The ABS released the March labour market results last week; the news was positive.

- Total employment rose 32,200, well above the average monthly rise of 25,670 over the past 12 months.

- The participation rate rose back to 67.8% after dropping slightly last month.

- More than 1.15 million jobs have been added since March 2022, at an average monthly gain of just over 32,000.

United Kingdo m

In the UK, the labour market reveals a very different story and mood.

- According to just-released data, the estimated number of vacancies in the UK fell by 26,000 across the most recent quarter (January to March 2025). This was the 33rd consecutive quarterly decline (reported on a rolling quarterly basis, monthly).

- This was the 33rd consecutive quarterly decline.

- Most pointedly, vacancies are now 15,000 (1.8%) below their March 2020 quarter level, just before the COVID-19 lockdowns began.

By contrast, Australia’s vacancies (328,900) are 45% higher than just before the COVID-19 lockdowns began. Between March 2022 and March 2025, the UK’s total employment rose by 1.13 million, while Australia’s rose by 1.15 million.

Australia beat the UK in total job growth and smashed the UK in percentage terms, with an 8.6% rise in total employment, more than doubling the UK’s 3.5% rise.

The grim news in the UK kept coming this week, with the country’s highest-profile white-collar recruiters, Hays, Pagegroup, and Robert Walters, all reporting a continuation of year-on-year sales and profit declines.

The Hays share price is trading at a 13-year low.

Pagegroup shares haven’t been this low since early 2009, and you have to go back nearly 12 years to find Robert Walters shares trading this cheaply.

The latest #LabourMarketTracker from REC shows a deep decline in active job postings since May 2023, although the last few months have seen a slight uptick.

The dire mood of UK recruiters might be captured by a rather dispiriting article on the Staffing Industry Analysts website, The recruitment industry is in crisis — and no one is listening, in which the author, Nick Gordon founder of Meraki Capital and Chairman of UK recruitment agency Hamlyn Williams, outlines his very pessimistic take on the future of the recruitment industry in the UK.

The opening sentence sets the tone for the 550 words that follow.

The UK’s recruitment industry is on the verge of collapse. I believe a perfect storm of government policy, high interest rates and technological shifts is putting thousands of jobs at risk.

Gordon continues,

Recruitment is going to be punished. Recruitment firms are being forced into catastrophic financial positions. I’m seeing two companies fold every week where usually we’d only see one a month.

Gordon, in fact, underestimates the rate of recruitment agency collapses; the official data reveals an average of ten agencies in the UK collapsed into insolvency every month of 2024.

Meanwhile, the latest KPMG and REC UK Report on Jobs survey indicated that hiring activity across the UK fell again in March. Recruiters reported that weaker confidence around the economic outlook, tighter client budgets, and fewer job openings led to notable falls in permanent placements and temp billings. At the same time, overall vacancies fell at a softer but substantial rate.

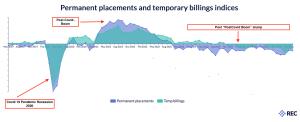

The chart below is one of my favourites from the REC for providing context. The annotations are mine.

Note the massive downturn when COVID hit. No surprise there. Everyone remembers that. But see the post-COVID boom, which was as welcome as it was a surprise. Most recruiters made hay then, and some got sloppy, too. Then, the decline. It’s not deep like any of the previous real recessions. But it is long. So long. And that is where the pain is felt.

This is not a jingoistic “Us vs. Them” blog from an Australian. I worked in the UK for two years and ran and owned a business there for a decade. I am currently a part-owner of a recruitment business in London and have dozens of good friends in the industry. And despite these numbers, Australia is doing it tough, too.

For the foreseeable future, the UK will comfortably remain the third-largest recruitment and staffing market (by revenue, after the USA and Japan), with more than double the expenditure of seventh-ranked Australia.

However, it looks like the golden age of sales and profit in the UK recruitment market is gone. Who is prepared to predict its return soon?

My thanks again to Ross Clennett, who collated most of this data and wrote 80% of the copy above

I take no credit for it, but I wish to amplify his message because it interests many.

Meet Ross HERE

See his excellent blog HERE

Subscribe to his blog HERE

***************************************************************************************************************************************************************************************************************************************************

JK Rowling is not shaking in her boots, but for niche business books, these two have done well.

I believe they will help recruiters and recruitment owners. Literally hundreds of peope have written to me to say just that.

Get ‘The Savage Truth’

Get ‘Recruit. The Savage Way’

*****************************************************************************************************************************************************************************************************************

- Posted by Greg Savage

- On April 22, 2025

- 1 Comment

1 Comment